Lets explore CANSLIM method of choosing stocks. The idea is to get into high-growth stocks before the institutional funds are fully invested. When the market hitting new highs, picking stocks is even more difficult. Investors also face the eternal dilemma: should they go by the fundamentals of a company or decide on the basis of technical factors that help time the market? Putting the two together can be a winning strategy.

A combination of the two works better. Fundamentals analysis give the conviction to hold the stock, and technical analysis provide attractive entry and exit points,”. If you are wondering about how to combine the two approaches, the CAN SLIM methodology is just the thing for you.

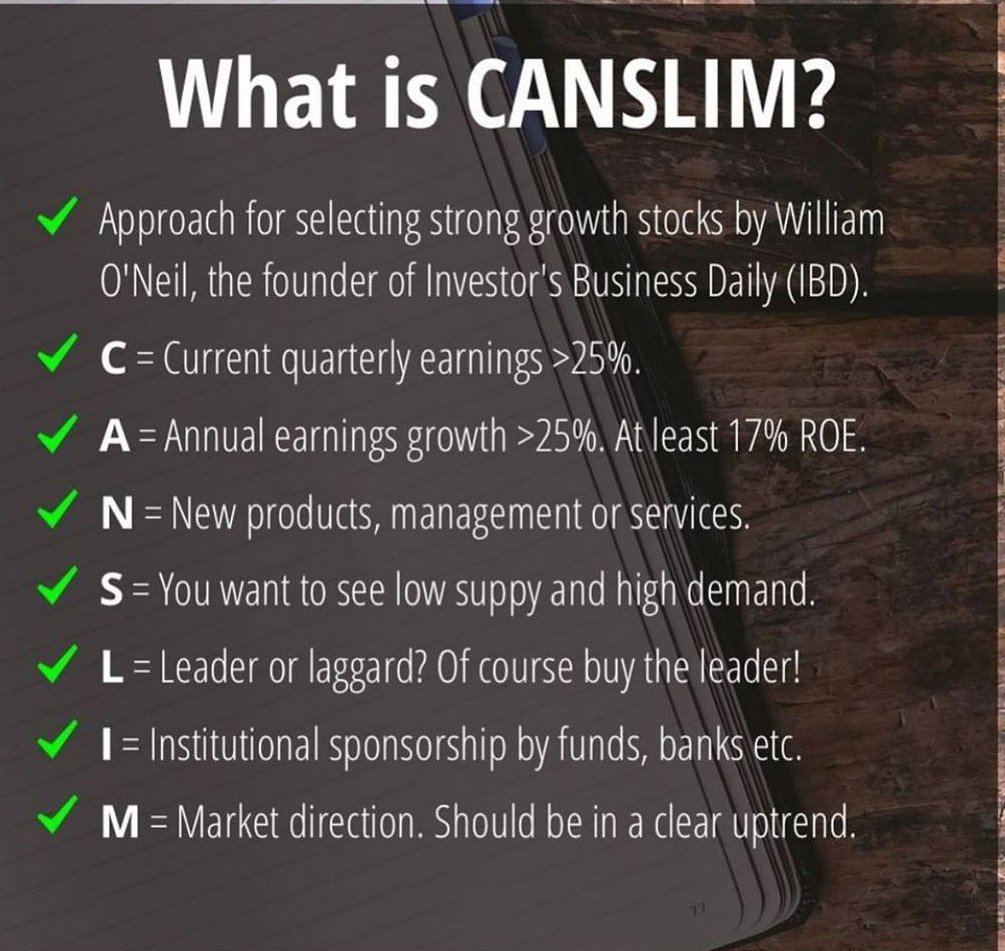

Developed by investor William O’Neil, CAN SLIM is a techno-fundamental strategy that helps pick quality stocks. This strategy focuses on companies that show acceleration in earnings because of innovation and suggests buying them before the stock price witnesses a major spike. For investors who cannot hold stocks for an extended period—more than five years—techno-fundamental strategy promises potentially better return.

How the CAN SLIM method works

Focus on both a firm’s fundamentals and market technicals helps pick quality stocks.

C: Current quarterly earnings of a firm

Growth of at least 25% is a good starting point. Also, look at earnings acceleration over the last three quarters.

A: Annual earnings growth

Look for annual earnings and sales growth of at least 25% for the past three years and a return on equity of more than 17%.

N: New product, service or management

The biggest winners of the past had one thing in common: New products, new services, new leadership, new pricing or a new condition in the industry.

S: Supply and demand

Look for heavy-volume accumulation by institutional investors, particularly at key moments like when the stock is breaking above prior resistance levels.

L: Leader or laggard

Buy leading stocks from the leading industry groups

I: Institutional sponsorship

For a stock to be a top performer, it must have institutional support to fuel its price movement.

M: Market direction

Three out of four stocks follow the market’s trend, so trade in sync with the market.

“Though people should avoid blind approach for spotting stocks on techno-fundamental basis, they should use traditional methods (which combine the two strategies) and success rate of such strategies are 70-75% over the years.

Buy right, sell right:

When picking stocks, price is most investors’ chief concern. Stocks that are available ‘cheap’, as indicated by a low price-to-earnings (PE) ratio, are preferred over ‘expensive’. But cheap stocks may be priced low for a reason, just like a high PE stock may be trading at a premium for a good reason.

“In pursuit of low PE stocks, investors sometime tend to miss out on some big winners,”. Infosys is a case in point. Infosys’ PE ratio touched almost 100 in 2001, when its earnings and sales were growing at over 100%. Based on just the PE ratio, the stock was way too expensive, and many would have avoided buying it.

But, Infosys turned out to be one of the biggest wealth creators in India’s stock market history. PE ratio, therefore, is not always the best indicator of stock price movement. The CAN SLIM strategy can be a better alternative to selecting quality stocks.

According to markets research firm William O’Neil India, whose model stocks have seen an average PE expansion of up to 130%, the market’s best-performing stocks debunk the over-reliance on PE ratios for astute stock selection.

Investors should not rely solely on the PE of a stock, instead look at high-quality businesses with sustainable competitive advantages, even if they are not ‘cheap’. CAN SLIM helps identify such businesses.

Now, buying stocks for capital appreciation is just the start. Selling them at the right time is equally important for booking profits as well as capital preservation. “Following stop loss is very important when you pick any techno-fundamental strategy,”.

CAN SLIM methodology not only helps you pick stocks that have a greater possibility of seeing a price appreciation, it can help you stop loss in case a company’s fortunes take a turn for the worse—as was the case with Satyam. “As advised by CAN SLIM method, cutting losses at 8% can help investors protect their capital from a huge loss,”.

If you want to book profits, especially when a stock you own is up more than 20% in just a few weeks, but are unsure whether or not to sell, CAN SLIM can help you make the decision. If the stock is still being bought by institutional investors, there’s a possibility of further upside to it. In such a case, say experts, hold it for at least eight weeks, before you decide to sell it.

For stocks that haven’t seen a sudden spike, the sell signals include trade volumes falling below 50-day moving average—indicating institutional selloff— negative news that can affect a company’s future growth and/or, weakening company fundamentals reflected in its quarterly numbers.

Related Posts:

What is stock screener? How to use a Stock Screener to Find Winning Stocks?

What Are Penny Stocks and Why Are They So Popular?

What is nifty heatmap? How to use NSE heatmap for Indian stock market?

How to Trade on the basis of Moving Averages of stocks?

How to trade 52week high stocks & 52week low stocks?

How to trade high dividend paying stocks?

How to Invest in Nifty 50 Share Price: Tips and Strategies?

How to Invest in BankNifty Share Price: Tips and Strategies?