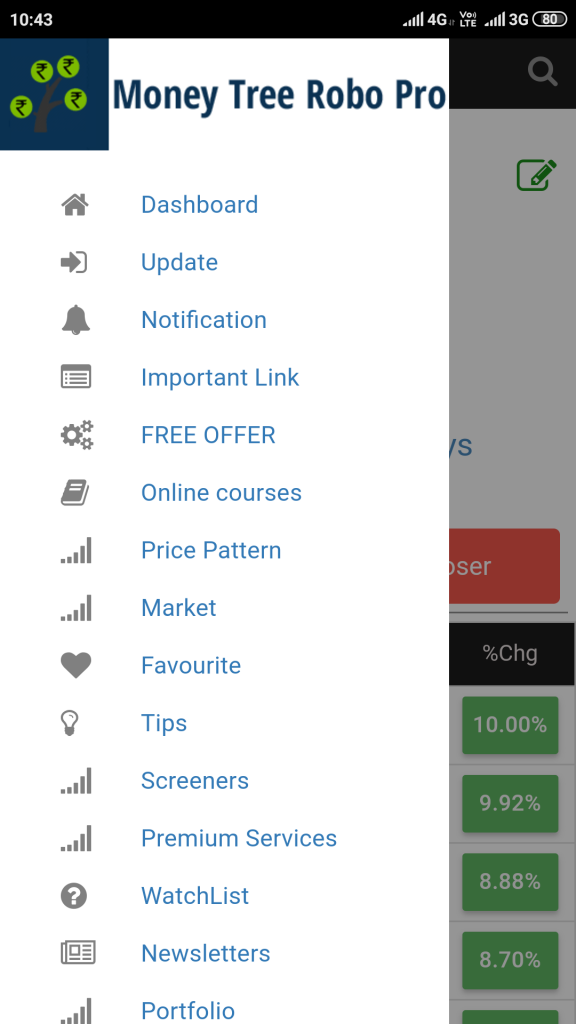

Money Tree Capital Dot Com (mntreecapital.com) is focussing on developing best in class stock market app and robo advisory services through app call Money Tree robo.

Why Money tree robo is needed

Everyone knows retail traders and investors loss their hard earned money in stock market. This figure is around 90-95%.

Why People loss:

The reason behind losses are as below.

- Don’t know “ What to Buy”

- Don’t Know “ When to Buy”

- Don’t Know “ When to Exit and When to Hold”

- Margin Trading

- Intraday Trading

- In hurry to make Killing in stock market means don’t have discipline & paitence.

- Lack of knowledge

The founder of Money Tree Robo has same story of losing money in stock market like all others. He started his carrier in 2006 through RPL ipo. After selling RPL in profit, he invested more money in the market to get quick gain. Then he lost almost 80% invested capital in 2008 crash.

At that time, what he buys it goes down. What he sells, it goes up within 2-3 days. Then he started reading books of stock market. Within 2-3 yr periods, he read more than 100 books and grabbed all the required knowledge which is needed to succeed in the market. After next 1-2 yrs, he covers all his losses and become profitable.

Then he analyses why he and other people loss in the market. He list down above problems and decided to solve them. Then, Money Tree Robo development started and now solving all these problems.

By the end of development, founder read more than 250 books. Money Tree Robo is zist of all those reading and experiences.

Founder wants everyone should have a second earning income source and create wealth for your future and retired life. He is devoted to create wealth for every retail traders & investors. Also happy to educate them about equity investing.

How Money Tree Robo will help everyone:

Following is the way through which it will help.

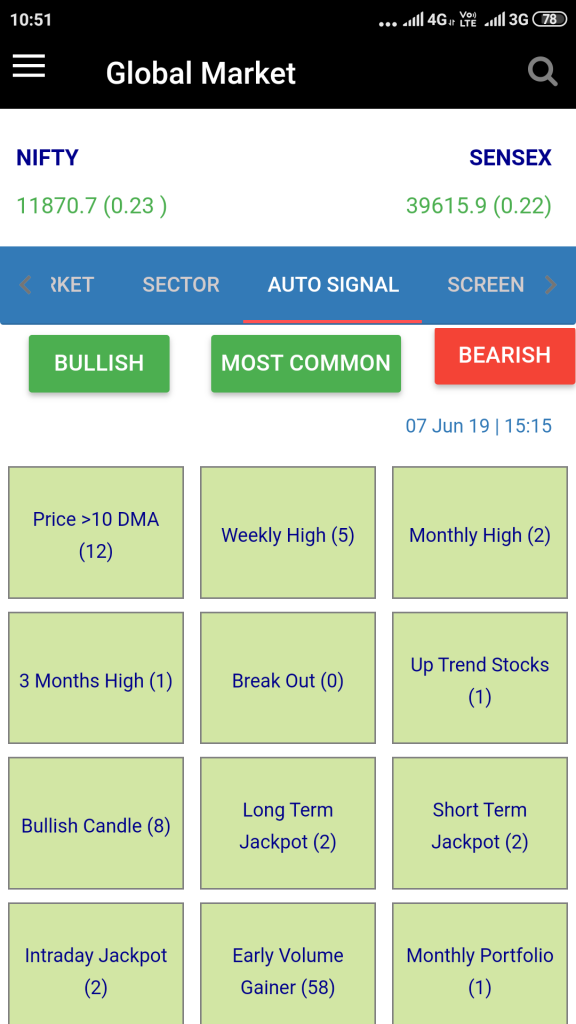

- Signal for every stocks like “ JackpotBuy, ShortTbuy, LongTBuy, JackpotSell, LongTSell, ShortTSell etc.

- Easy representation of all Technical Datas like SMA, Volume, Volume averages, Pivot Points for Daily,Weekly,Monthly etc,Buy Above and Sell below levels, performance of stocks, Targets and Stop Losses etc on signle page.

- Trend for every stocks.

- Easy way of chart reading. Within 1 minutes, expert can see 15-20 stock charts.

- Easy decision for BUY/SELL within 1 minutes. Otherwise use our BUY/SELL decision within a second.

- Suggesting “ Right stocks at the right time”.

- Nice stock screener live and EOD. Customised stock screener also.

- Unique Robo Portfolio: It suggest on behalf of you which stocks to BUY as per your age, time horizon, risk profile etc.

Why we should invest in stock market:

Creation of wealth is a long term process. Wealth can be created in stock market through systematic and disciplined way. There is no short cut route in this Stock market. India is growing country.

We will make money until we become developed like US economy. Only 2% people of india invest in equity. So there is huge scope of growth. Stock market is proxy of any country development and growth. So as India will grow, stock market will grow.

Equity is best asset class:

Stock Market is one of the best investment tool to grow your wealth in long term say 5-7 yrs period if you put your money in well researched stocks or Bluechip stocks. Nifty 20 yrs average return is 17%. It is far from fixed deposits. Minimum return, you will get 3-4times the saving account in long run.

Equity is very liquid investment. Any time you can sale your stocks and use the money if you needed. This is not the case with property and other asset class. Your saving should be diversified among other asset class also say Gold, Property, Bond, Equity etc.

Thumb rule of equity investment is hundred minus your age, should be in equity. Example, if your age is right now 30, then 70%(100-30=70) of your saving should go to the Equity and rest should be distributed to other asset class like gold, property, bond etc.

You can beat the market or fund manager if you have some knowledge and nice app like MONEY TREE ROBO. Money Tree Robo recommend the “Right stocks at the right time”.

In my knowledge and experience, stock market investment can prove to be the best second earning source. Here, if you assume loss of 100% in 3-4 stocks out of 10, but gain has NO LIMIT in long run. It may be minimum 100-300% in 3-4yrs.

Even some stocks can give you 10 times during this time frame if you pick at right time. Everyone know, “High Risk High Gain”. But in long run say 5-7 yrs, there is no risk at all. If you believe that your country is growing, then there is no fear of stock market going down in long run.

But key is “ How to get the right stocks at the right time”. Money Tree Robo is here to help you in choosing the right stocks at right time.

Related Posts:

How to Analyze FII DII Data for Stock Market Investments?

A Beginner’s Guide to Technical Analysis on Stocks

A Beginner’s Guide to Investing in the Stock Market

Stock market what is? How stock market works?

How Stock market works:

Market and stock movement is the result of so many factors at a time. Minimum 10-15 logic works at a time for any stock and market. These logics are combination of Global , Domestic, Oil, Gold, Technical and Fundamentals all combined together.

If you master all these logics, you predict market 80-90% accurate. But it requires so much time and investment to learn all these things. Don’t worry, you no need to learn all these things, Money Tree Robo will analyse all these things and give only results to you.

Just follow below Simple Golden rules of equity investment.

- Don’t borrow money to invest in market. Invest the money which is not needed in near future say 2-3 yrs. Only surplus money should be invested.

- Don’t play in Margin unless you are expert in this field. Only play in delivery.

- Invest for minimum 5-7yrs time period. Balance your portfolio with minimum 4 sectors and maximum 16-20 stocks.

- Don’t trade INTRADAY if you are not expert and full timers.

- Retail investors and traders don’t forget my above rules. These are golden rules to make money from market consistently.

- If you liked our Money Tree Robo, then join hands with us, grow your wealth and make Money Tree Robo your financial advisor for life time.

Following is the way to join us:

- Twitter: https://twitter.com/Money_tree_robo?s=03%20India%27s

- Facebook:https://www.facebook.com/pg/Money-Tree-Robo-866994610159140/posts/

- Pinterest: https://in.pinterest.com/money4608/money-tree-robo-pro/

Mission & Vision: To educate 1 Million people about equity investing and produce world class stock market app and services which creates wealth for the people through equity investing.

Regards,

Money Tree Robo Team